HOW TO GIVE

“Give us hope. Take the credit!”

A tax deductible charitable donation to Opportunity Scholarships of Nebraska empowers families to choose the best option for their children, regardless of income or zip code. You can help create a brighter future for Nebraska’s students through a tax deductible charitable donation at any time. If you made a tax credit contribution to OSN in 2024, those funds have been or will be used to fund scholarships for qualified Nebraska students across the state.

How to claim your tax credit contribution:

You should have received a receipt like this for your contribution to OSN. If you cannot find it, please email us at givehope@nebraskaopportunity.org to request a copy. This receipt is merely for your reference or to give to your tax preparer. The Nebraska Department of Revenue has record of every taxpayer’s contribution.

Your contribution to OSN qualified for a dollar-for-dollar Nebraska State Income tax credit up to 50% of your liability on your 2024 taxes. You may also choose to carry forward remaining credits for up to five years.

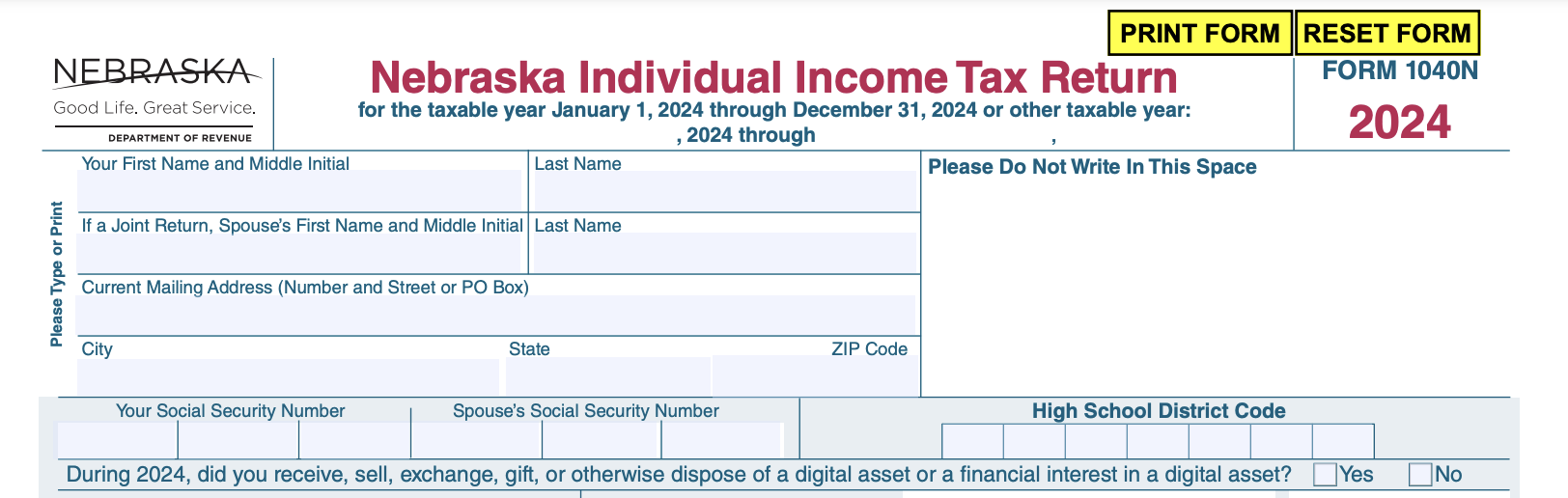

If you are filing as an individual taxpayer, the Opportunity Scholarships Act tax credit is

listed on line 30 of Form 1040N.

If you are filing as a Corporation, the Opportunity Scholarships Act tax credit is listed on

line 18 of Form 1120N.

If you are filing as a S Corporation or Partnership, the Opportunity Scholarships Act tax credit is listed on line 12 of Form 1120SN and Form 1065N.

We understand that programs like TurboTax and TaxAct have this tax credit listed. If you have any other questions about your specific tax situation, we recommend asking a tax professional or your accountant.

Thank you for giving kids HOPE through the Opportunity Scholarships Tax Credit!

Want to make a tax-deductible charitable gift?

OSN is a 501(c)(3) nonprofit organization, so you can give a tax-deductible charitable donation to OSN at any time without limit to help us get off the ground running and educate Nebraska families and students about the new scholarship program.

Opportunity Scholarships of Nebraska has been recognized as exempt from income tax under Section 501(c)(3) of the Internal Revenue Code. You should consult your personal tax advisor about the deductibility of your contribution and your record keeping obligations.

FREQUENTLY ASKED QUESTIONS

Why can’t I make a tax credit contribution before the end of the year?

LB753, the tax credit scholarship program, was sunset on October 31, 2024, after many attacks by the opponents to educational opportunity. Despite confusion and disinformation spread by opponents, OSN was still able to raise nearly $10M in contributions to serve more students and families across the state of Nebraska.

What if I contributed more than 50% of my state income tax liability.

If you give more than 50% of your 2024 liability, you can carry it over for up to 5 years. Even though the credit expires on October 31 of this year, the Dept of Revenue has stated it will honor the 5 year carryover provision (the second question on this page).

So, if you contributed $10,000 to OSN this year, but you only end up with a $18,000 state income tax liability, you can claim 50%, or $9,000, for 2024 and claim the remaining $1000 in 2025.

LB753 was sunset on October 31. Will I still be able to claim my tax credit?

Yes! According to the Nebraska Department of Revenue, donors will still be able to claim a tax credit for their contributions on their 2024 taxes as long as the contribution is complete by October 30, 2024. This includes the five-year carryover provision.

Can I give to OSN to support their mission?

Of course! You can still give a tax deductible charitable donation to OSN to support our mission of advancing school choice in Nebraska. See above for the link!

Still have questions? Please contact us at givehope@nebraskaopportunity.org.